In case of exceptions, can the process be sidestepped? If so, what happens then?.To what extent your staff will be involved in the process? (vs.What are your main cash flow drivers? (how do you define your business model?).Process – Getting to a well-oiled machine - choose: Will you recognize forecasting performance? (e.g.What other stakeholders will use the forecast? (e.g.How will the different contributors and users consume the outputs?.Who will be contributing to generate the forecast?.Who will be the main users of the reports and analyses? (operational vs strategic or both).If you would like to combine both, choose how the reconciliation would work?Ī possible output – reporting on Cash position & Cash forecast 2.Ěudience – define your stakeholders and what they need:.What does successful (output look like? (formats, visuals…).focus on short term (direct) or longer-term (indirect), or a combination of both Do you want to perform an indirect or a direct cash forecast e.g.Set your goals & requirements – getting to the why - decide:

Treasury cashflow forecasting how to#

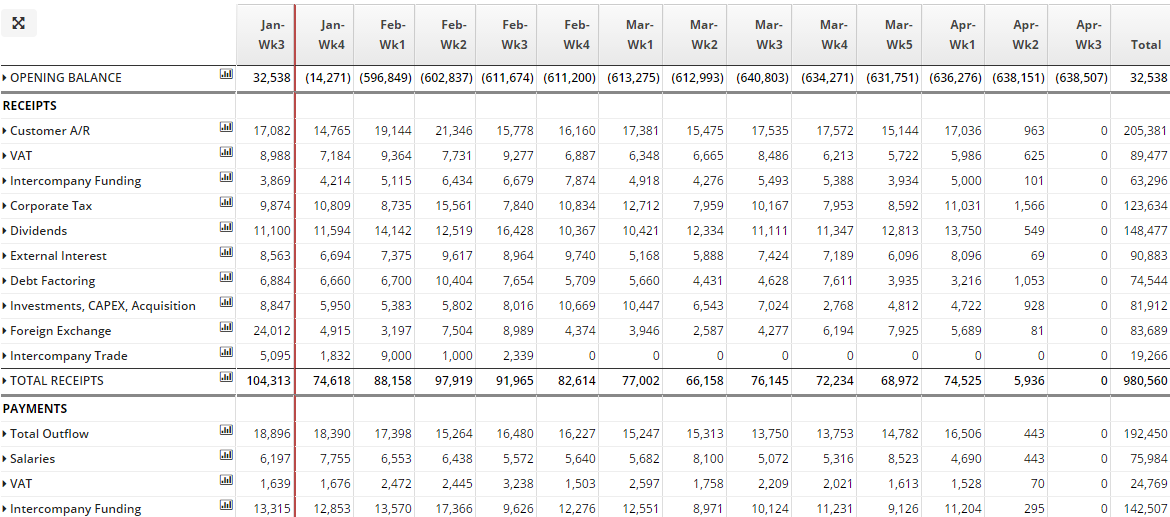

Don’t know where to start, or how to fill in the blanks on further optimizing your current process? Then follow this Checklist. Improving your forecasting results is more than relying on hard data, but bears fruit in the synergy of art and science. Setting sensible assumptions and providing contingencies that offer flexibility in case of unexpected events are a few quintessential things to consider. multiple systems, entities, currencies, etc.Īdditionally, it doesn’t stop at regularly getting the right information in a timely and efficient matter. However, in reality, it’s not that simple and a lot of challenges arise in getting an acceptable end result, especially when complexity increases i.e. Ranging from the cornerstone of a finance & treasury department to the lifeblood of any organization it’s fair to say cash forecasting is vital to get an accurate prediction of an organization’s health.Ĭash forecasting, at its core, is simply identifying all the various in & outflows over a given period in order to analyze and compare those estimations with your actuals. Nicolas Christiaen, CEO & Founder, CashforceĬash flow forecasting has been called many things in literature.

0 kommentar(er)

0 kommentar(er)